Hot Topics Article Archives

Cheers to 90 Years! NSAC is Celebrating a Milestone!

The National Society of Accountants for Cooperatives is thrilled to celebrate its 90th Anniversary—a milestone marking nine decades of supporting professionals in cooperative financial management and planning while advancing the cooperative model. Since 1935, NSAC has been the go-to for industry-specific education, resources, and connections. We’re kicking off the celebration in style at COMPASS, where attendees, both virtual ...

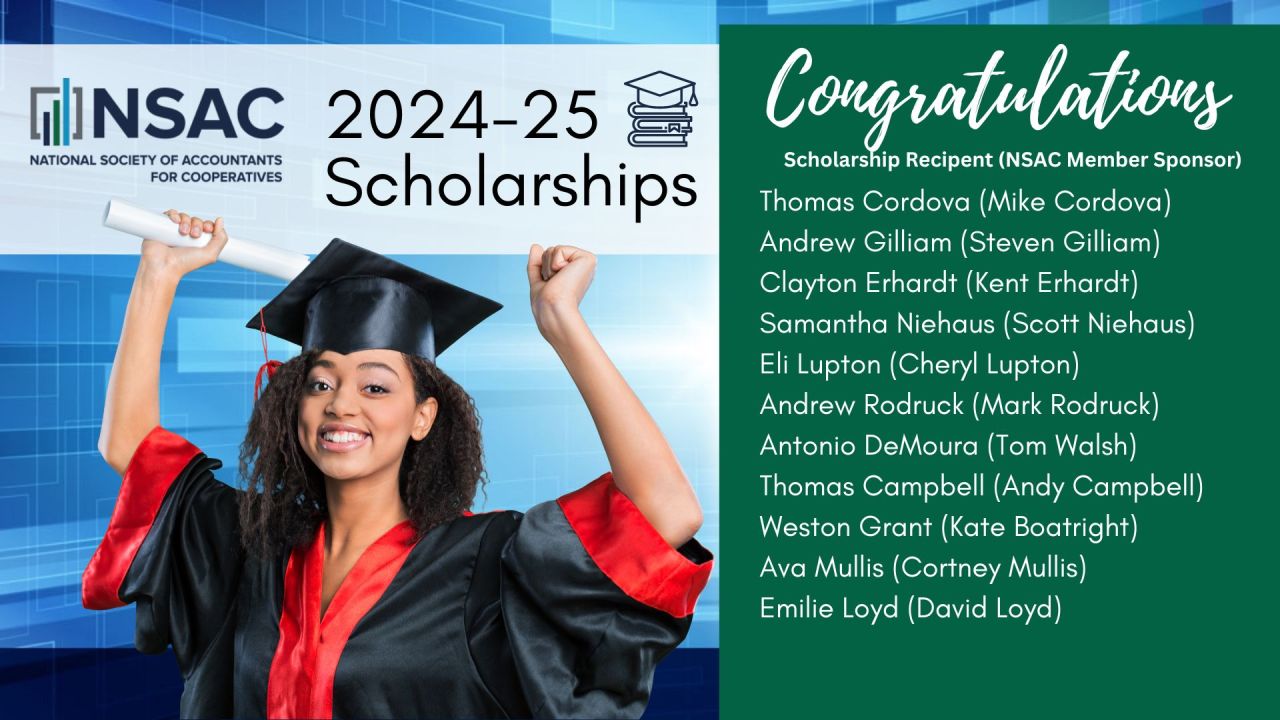

Read MoreNSAC Congratulates 2024-2025 SCHOLARSHIP RECIPIENTS!

The NSAC would like to congratulate the scholarship recipients for the 2024-2025 academic school year! We're thrilled to announce that this year saw entries from many talented individuals, making it an exceptionally competitive selection process. The Society is proud to commend these outstanding students for their remarkable academic achievements, and we're confident they'll reach new heights in their pursuit of ...

Read MoreClay Worden of RSM US LLP Named Recipient of 2024 Silver Bowl Award by National Society of Accountants for Cooperatives

[Cincinnati, Ohio, February 27, 2024] - The National Society of Accountants for Cooperatives (NSAC) is proud to announce Clay Worden, Partner at RSM US LLP, as the distinguished recipient of the 2024 Silver Bowl Award. This esteemed accolade, the highest honor within the cooperative industry, recognizes individuals whose exceptional contributions have significantly enhanced the reputation and functionality of the cooperative sector. For nearly ...

Read MoreTime Sensitive Alert: Re-Registering TCCs for 1099s

ALERT – TIME SENSITIVE: NSAC’s Tax Committee has learned that several taxpayers, who have historically filed their 1099s directly with the IRS via the FIRE system, have been caught off-guard by a new requirement. The key issue appears to be that Transmitter Codes issued before Sept 26, 2021 must have been re-registered in order to transmit 1099s in January of 2024. Below is an announcement from Thompson Reuters that ...

Read MoreTreasury Moves Forward with Database on Corporate Ownership

WASHINGTON (AP) — Tens of millions of small U.S. companies will be required to provide the government with details on their owners and others who benefit from them under a regulation finalized Thursday that’s intended to peel back the layers of ownership that can hide unlawfully obtained assets. The Treasury Department said it was moving to create a database that will contain personal information on the owners of at least 32 million ...

Read More.png)

.png)