NSAC Happenings and Latest News - Page 10

TAXFAX Summer 2024

Washington Update As of mid-April the fate of federal tax legislation is uncertain. On January 31 the House approved H.R. 7024, the "Tax Relief for American Families and Workers Act of 2024," by a vote of 357 to 70. The Senate has not yet taken up the bill, which contains several key business tax relief provisions, including: Delay five-year amortization of domestic research or experimental costs until taxable years beginning after ...

Read MoreFASB ISSUES ASU 2024-01 March 2024 COMPENSATION-STOCK COMPENSATION (Topic 718) Scope Application of Profits Interest and Similar Awards

Purpose and Rationale The FASB issued this Update to clarify the application of GAAP to profits interest and similar awards. These awards, which are often used to align compensation with an entity’s performance, have led to inconsistent accounting practices. The Update aims to provide clear guidance on whether these awards should be accounted for under Topic 718 (Compensation—Stock Compensation) or other compensation-related ...

Read MorePool of Accounting Graduates and Potential Accounting Careers

A 2023 report by the American Institute of Certified Public Accountants (AICPA) noted that the number of college accounting graduates dipped in the 2021-2022 academic year. The report, “2023 Trends: A Report on Accounting Education, the CPA Exam and Public Accounting Firms’ Hiring of Recent Graduates”, indicated that about 47,000 students earned a bachelor’s degree in accounting in the 2021-2022 school year. This was down ...

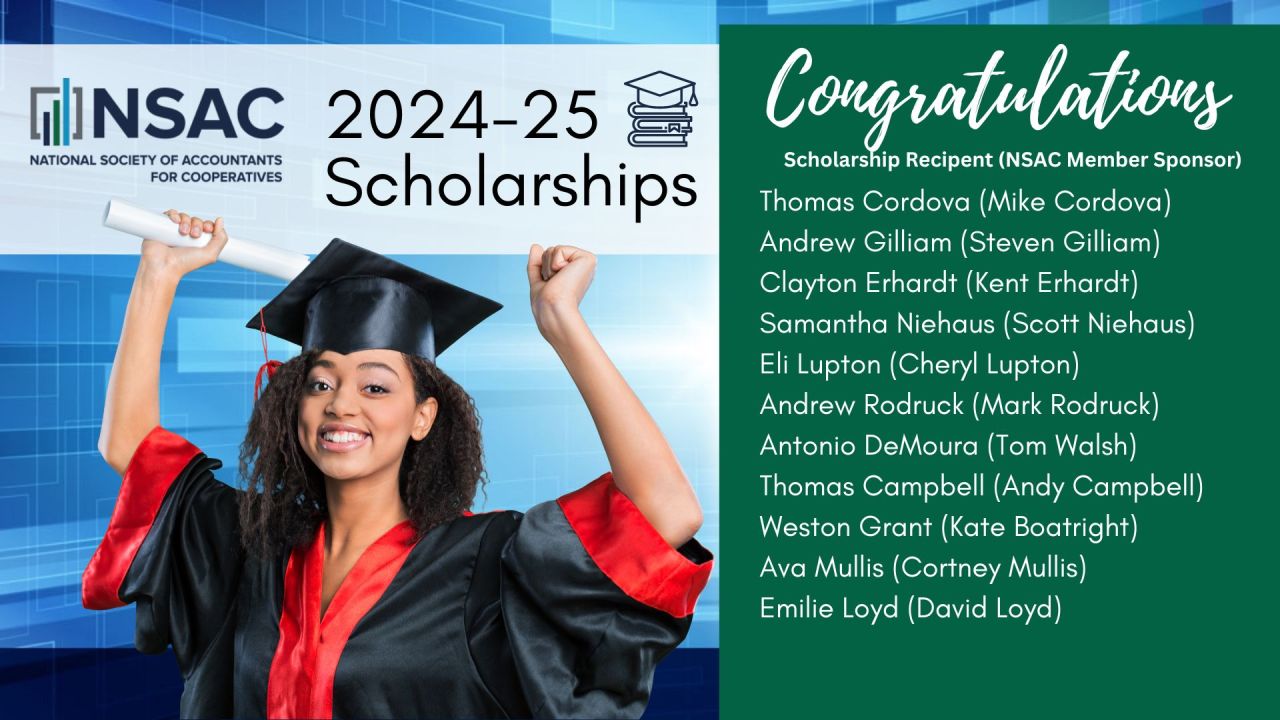

Read MoreNSAC Congratulates 2024-2025 SCHOLARSHIP RECIPIENTS!

The NSAC would like to congratulate the scholarship recipients for the 2024-2025 academic school year! We're thrilled to announce that this year saw entries from many talented individuals, making it an exceptionally competitive selection process. The Society is proud to commend these outstanding students for their remarkable academic achievements, and we're confident they'll reach new heights in their pursuit of ...

Read MoreASU’s falling under ASC Topic 326 Update 2016-13 —Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments

This update was subsequently updated ASU2018-19, 2019-15, 2019-11, 2020-03, 2022- 02 Effective Date: Public entities that are U.S. Securities and Exchange Commission filers, this update is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. For all other entities, as amended by ASU 2019-10, fiscal years beginning after December 15, 2022, including interim periods within those fiscal ...

Read More