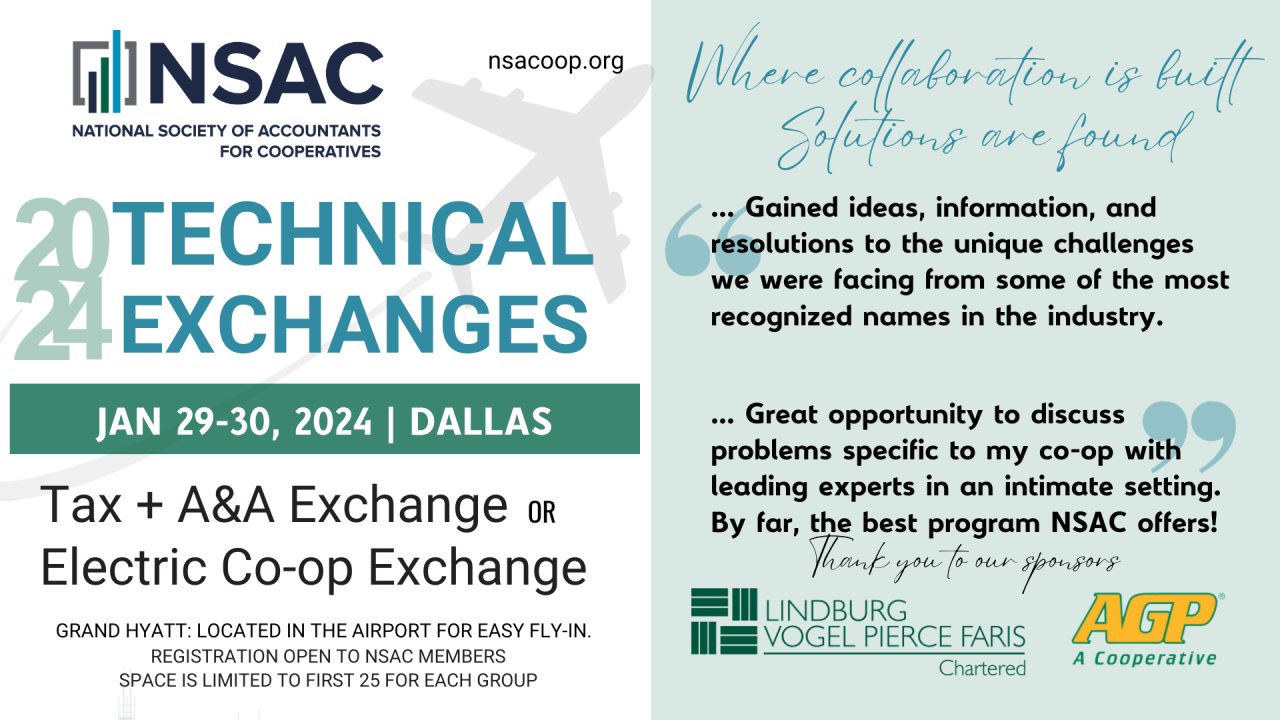

2024 Technical Exchange

GRAND HYATT DFW (Located in the airport)

2337 S INTERNATIONAL PARKWAY

DFW AIRPORT, TX 75261

United States

Please note the Electric Cooperative Exchange has reached capacity. You may request to be put on a waiting list by emailing deedee@nsacoop.org. The Tax + A&A has a limited number of spots left available.

Be a part of the 2024 Technical Exchange, happening on January 29-30, 2024. Immerse yourself in this one-and-a-half-day fly-in event, featuring dual technical-focused exchanges. Participants can opt for either the Tax+A&A Exchange or the Electric Co-op Exchange. Crafted to empower individuals engaged in cooperative tax, finance, and accounting, this event is tailored to proactively tackle emerging challenges and demands. Although each exchange operates autonomously, meal times and breaks provide a chance to connect with fellow participants and build your professional network.

Bid farewell to mundane PowerPoint presentations – this innovative program centers around dynamic roundtable discussions and collaborative sessions. Seasoned professionals and leading experts in the industry roll up their sleeves and discuss those challenges and issues that are keeping you up at night. Participate to gain direct access to top experts within a small group setting, facilitating in-depth conversations around challenges specific to your cooperative or the cooperatives you're engaged with.

TAX+A&A EXCHANGE (Capacity: Limited to first 25)

Rebecca Thoune, CPA, Signing Director, CliftonLarsonAllen, LLP

Nick Mueting, CPA, Shareholder, Lindburg Vogel Pierce Faris, Chartered

Eric Gillam, CPA, Partner, Aldrich CPAs + Advisors LLP

This working roundtable is a collaboration among leading experts and peers that will take a deep dive into emerging issues and topics identified as relevant to those involved in the financial planning and management of cooperatives. However, the conversation is fluid, and the attendees will control the flow and content of the Exchange. We encourage you to bring the challenges you are facing for discussion and actively engage in solution-based collaboration and strategy with your peers.

- Update from the working groups that came out of Jan 2022 Exchange

- Patronage – Book/Tax

- Making the switch

- Allocations of M1s

- Section 199 A9(g)

- 10% safe harbor

- Patronage – Book/Tax

- 163(j) and the use of the Alternative Depreciation System (ADS)

- Potential positives and negatives of ADS

- 199A(g)

- Updates on where it stands for permanence

- Challenges of cooperatives working in joint ventures together

- Tax issues especially with 163(j)

- Determination of patronage vs. nonpatronage

- Qualified vs. nonqualified notices of allocation

- How each affects the patron and when it is most advantageous

- Employee Retention Credits

- Position if client took an aggressive approach

- IRS audit activity

- Internal control hot topics and areas of concern

- Depreciation rates and salvage values

- Grant accounting and taxation

- Other equity issues

- Form 8300

- 263A and mark-to-market accounting

- Section 174 expenses

- Accounting for business combinations with stressed coop

- Best practices for IT controls and how to implement – Multi-factor authentication, endpoint protection, mobile device policy, phish testing, network traffic monitoring

- Changes to risk assessments

ELECTRIC COOPERATIVE EXCHANGE (Capacity: Limited to first 25)

Bill Miller, CPA, Tax Partner, Bolinger, Segars, Gilbert & Moss, LLP

Larry Andrews, MBA, CTP, Chief Administrative and Finance Officer, Rappahannock Electric Cooperative

The agenda includes a robust list of topics that will be led by discussion leaders, Bill Miller, Tax Partner, Bolinger, Segars, Gilbert & Moss, LLP, and Larry Andrews, MBA, CTP, Chief Administrative and Finance Officer, Rappahannock Electric Cooperative. However, we encourage you to bring the challenges you are facing to gain the most value out of this unique opportunity.

- Adopting & Implementing Broadband/Fiber.

Hot topic nationwide for Electric Coops. Some coops are laying the Fiber, with expectations of leasing it to ISPs (Internet Service Providers) in the future. Some Coops are actually getting into the ISP business. Discuss Pros and Cons, Issues to consider, and experiences encountered by various electric coops. Some states are highly regulated, and some are not. Has that impacted decisions on whether or not to get into Broadband? Different Broadband business models. - G&T power cost projections and Fuel Adjustments on electric bills

What are electric coops doing - Levelized, rolling 12-month average, projecting 12 months forward. Some coops are adjusting month to month (with significant swings, up or down, from month to month). Some coops are approaching fuel adjustments on an annual basis. Discuss Pros and Cons, Issues to consider, and experiences encountered by various electric coops. - Net Metering. When coops buy back electricity, do they offer different rates for purchases at 5:00 PM versus 11:00 AM?

- Telecommuting/Remote Work. How are electric coops handling this? Experiences?

- How to finance an Electric Coop. Different approaches? Experiences?

- FEMA and Mutual Aid in cases of hurricanes, tornadoes, snowstorms.

- Electric Coops in different parts of the country approach the staging of restoration resources differently. In states like Florida, there is generally only one way in and one way out; therefore, pre-staging restoration resources must be done in advance (otherwise there would be substantial delays in getting materials into the storm damaged area). Are coops considering “joint” staging contracts with others? FEMA impact? FEMA’s use of contractors? Experiences?

- Managing a close process and enforcing internal controls.

- Managing liquidity and cash with banking relationships.

- Depreciation rates and salvage values.

- How does newer technology fit into traditional rate groupings?

- Grant accounting and taxation

- Unrelated business taxable income

- Large power contracts and pat cap allocations

- Other equity issues

- Electric Rate Discussion

SUBJECT MATTER EXPERTS (SMEs)

SME- Internal Controls and Fraud

Steve Dawson CPA, CFE, President, Dawson Forensic Group

Steve Dawson will spend time with both exchanges and guide a dynamic conversation focused on the vital topics of internal controls and fraud prevention. This is a unique opportunity for you to actively engage, inquire about matters pertinent to your cooperative, and participate in collaborative discussions regarding the most recent developments in fraud prevention. Discover valuable insights on enhancing internal controls tailored to your cooperative's needs—all without the confines of content limited to a PowerPoint presentation.

Steve Dawson discovered his passion for Anti-Fraud work through the world of accounting. He built DFG in response to the evident need for focus in preventing, detecting, and assisting in recovery from the consequences of internal fraud. For almost 40 years, Dawson has performed forensic investigations and related forensic services for various businesses and agencies, representing industries ranging from federal and state governmental agencies to financial institutions, non-profit organizations, and a multitude of independently operated businesses. He is a nationally recognized speaker in fraud detection, prevention, and internal control design methodologies. He is a graduate of Texas Tech University with a Bachelor of Science in Accounting. He is a Certified Public Accountant in the state of Texas and holds a certificate as a Certified Fraud Examiner through the Association of Certified Fraud Examiners.

SME - GAAP & FASB Updates

Mike Cheng, CPA, National Professional Practice Partner, Frazier & Deeter

Join Mike Cheng as he guides you through an insightful exploration of your GAAP-related inquiries and the most up-to-date FASB developments. This exclusive opportunity allows you to pose pertinent queries tailored to your organization to tap into the wealth of knowledge from this highly proficient expert.

Mike Cheng joined Frazier & Deeter in 2019 as the Partner who oversees the firm’s professional practices related to accounting and audit. As part of this role, he specializes in assisting clients with complex accounting and financial reporting issues. Prior to joining the firm, Mike was a Senior Project Manager at the Financial Accounting Standards Board (FASB). At the FASB, he served as the Private Company Council (PCC) coordinator, where he was responsible for all PCC related matters. In addition, Mike led projects to simplify the accounting for non-employee share-based payments, help shape the future of the FASB technical agenda and improve consolidations guidance (VIE guidance). Most recently, he worked on the FASB’s implementation team on revenue recognition (ASC Topic 606) and lease accounting (ASC Topic 842). Prior to joining the FASB, Mike held various management positions with PricewaterhouseCoopers. He was an Audit Senior Manager, Private Company Services, in the firm’s Stamford, CT office. From 2003-2011, he also held roles of increasing responsibility in PwC’s Core Assurance divisions in Buffalo and Rochester, NY. He is a frequent speaker at the Tax, Finance & Accounting Conference for Cooperatives (TFACC) and other national conferences.

MEET OUR DISCUSSION LEADERS

ELECTRIC COOPERATIVE EXCHANGE

Bill Miller, CPA,Tax Partner, Bolinger, Segars, Gilbert & Moss, LLP

Bill Miller, CPA is a partner with the accounting firm of Bolinger, Segars, Gilbert & Moss in Lubbock, Texas. He began his career with the firm in 1992 and holds a degree in accounting from the University of Texas in Austin. Bill is in charge of the firm's utility and cooperative tax practice, providing tax and consulting services to exempt and non-exempt utility cooperatives, including related subsidiaries. Traditional responsibilities include tax research, tax planning, recommending entity types for new business ventures, and oversight of tax return preparation. Cooperative-specific responsibilities include compliance with co-op principles and plans to allocate and redeem patronage capital. In addition to working with the firm's audit clients, Bill has consulted with trade associations in providing guidance on tax and equity issues pertaining to the electric cooperative industry. Past guidance includes consulting with the Capital Credits Task Force and also providing technical assistance on a national level regarding the tax impact of proposed legislation on electric cooperatives. Bill is active in the National Society of Accountants for Cooperatives. He has served as a past National President and a National Director representing the Electric Cooperative Chapter. Bill is a recipient of the Silver Bowl, the industry's most prestigious award, and is a frequent speaker at the Tax, Finance & Accounting Conference for Cooperatives (TFACC).

Larry Andrews, MBA, CTP, Chief Administrative and Finance Officer, Rappahannock Electric Cooperative

Larry Andrews is the Chief Administrative & Finance Officer for Rappahannock Electric Cooperative (REC). His impressive journey within REC has seen him take on various pivotal roles, each contributing to his extensive experience and expertise. Prior to his current position, Andrews served as Manager of Administrative Services for 4 years and Director of Finance & Accounting for 6 years. Prior to that, he was REC’s Treasury and Financial Services Specialist for over 8 years. He spent three years prior to being hired by REC as a coordinator of contracts and budgets for Intellisource, an information technology company that supported REC. Andrews gained valuable financial experience during the ten years prior to Intellisource by working in the savings and loan industry. Andrews holds a bachelor of science in business management from Virginia Tech. He earned his master of business administration from the University of Mary Washington in May 2011. He graduated from the Virginia Bankers Association School of Bank Management as an honor graduate in 1995. Andrews is a certified treasury professional (CTP) as designated by the Association for Financial Professionals. Andrews also served on the National Society of Accountants for Cooperatives’ Electric Cooperative Chapter Board from 2011 to 2022. He is a competent communicator (CC) with Toastmasters International.

TAX + A&A EXCHANGE

Rebecca Thoune, CP, Signing Director, CliftonLarsonAllen LLP (CLA)

Rebecca Thoune is the Sidnging Director at CLA and has an extensive background in providing tax planning and compliance for privately held companies, serving primarily cooperatives and the agribusiness industry. She works with clients on federal and state strategic tax planning, equity planning and management, maximizing cooperative and patron benefits, business structure consulting, and provides representation before the IRS and other state taxing authorities.

Rebecca has 23+ years of tax experience in public accounting and has held various tax leadership roles throughout her career. Rebecca has spoken to various local and national organizations on technical tax topics such as the principles of cooperative taxation, tax planning and reform, equity management, COVID relief including PPP loans & forgiveness, and various state tax matters. Rebecca serves as the cooperative national tax director for CliftonLarsonAllen LLP. She is a frequent presenter at Tax, Finance & Accounting Conference for Cooperatives (TFACC) and is currently serving as the Chair of the NSAC Tax Committee.

Nick L. Mueting, CPA, Managing Shareholder, Lindburg Vogel Pierce Faris, Chtd.

Nick Mueting is a Certified Public Accountant and managing shareholder with the auditing firm of Lindburg Vogel Pierce Faris, Chartered in the Dodge City, Kansas office. Nick works mainly in the agricultural cooperative industry as an external auditor and has special interest in internal controls and risk management. Nick is a Past National President for NSAC, is a frequent presenter at Tax, Finance & Accounting Conference for Cooperatives (TFACC),and currently serves as the Chair of the Accounting & Auditing Committee.

Eric Gillam, CPA, Partner, Aldrich CPAs + Advisors LLP

Erik Gillam is a CPA and partner at Aldrich CPAs + Advisors LLP. He joined Aldrich in 2004 and has spent his entire career focused on providing assurance audits,reviews and compilations to agricultural cooperatives. Erik leads the agribusiness niche at Aldrich. As a leading agribusiness consultant, Erik has experience working with a range of agricultural-related clients from small family-operated farms to large cooperative organizations that are owned by farmer members. Erik works with company owners to understand their financial situation and help them improve on processes. Erik graduated from Corban University. Erik is currently serving as the NSAC National Vice-President and Past Chair of the Accounting & Auditing Committee.

TENTATIVE SCHEDULE

Each Exchange will work through challenges and discussions separately but come together for networking during meals and breaks.

All times are Central Time

January 29, 2024

12:00 PM Lunch

1:00 PM – 5:00 PM Exchanges

5:30 Happy Hour

6:00 PM Dinner

January 30, 2024

7:00 AM Breakfast

8:00 AM – 12:00 PM Exchanges

REGISTRATION

With more than 8 hours of enriching programming, discussions, and knowledge exchange, the event offers comprehensive course materials, CPE credits, and well-planned meals. Situated at the conveniently accessible Grand Hyatt inside the Dallas Airport, this fly-in event promises convenience.

To ensure focused dialogue, limited slots are available for each exchange, fostering an atmosphere of meaningful exchanges. Feel free to request placement on the waiting list once registrations reach capacity by emailing info@nsacoop.org.

Open to NSAC members only.

Limited to the first 25 people for each session.

Registration Cost: $400 per person (does not include transportation, overnight accommodations or non-scheduled meals)

HOTEL

GRAND HYATT DFW

2337 S INTERNATIONAL PARKWAY

DFW AIRPORT, TX, 75261-9045, US

Hotel Registration: $229 + tax per night

The deadline for Hotel registration is January 7, 2024.

THANK YOU TO OUR SPONSORS

Platinum Sponsors AG Processing Inc A Cooperative

AG Processing Inc A Cooperative

A leading agribusiness cooperative engaged in procuring, processing, marketing, and transporting oilseeds, grain, and related products for the benefit of our cooperative members and their farmer-owners. Since our formation in 1983, AGP has grown in size, scope, and reputation — both in the U.S. and internationally. Lindburg Vogel Pierce Faris, Chartered (LVPF)

Lindburg Vogel Pierce Faris, Chartered (LVPF)

More than just an accounting firm! At Lindburg Vogel Pierce Faris, we propel the future of rural Kansas through partnerships with cooperatives, business owners, and individuals. We provide thorough and expert accounting solutions to everyday people doing extraordinary things across our great state. With offices in Hutchinson, Hays, and Dodge City, we serve the better part of Kansas and help make it a little better.

BECOME A SPONSOR

Would you like to enhance your brand visibility, connect with influential leaders in the industry, and contribute to NSAC's efforts in delivering distinctive educational experiences for those involved in tax, finance, and accounting for cooperatives?

The National Society of Accountants for Cooperatives (NSAC) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor (#103068) of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.