Is Goodwill Accounting’s Future in the Past?

Investors don't want to go back to an amortization model, but that's the way FASB is leaning.

Portfolio managers and other investment professionals surveyed by the CFA Institute last week would prefer the Financial Accounting Standards Board (FASB) not travel back in time 20 years to attempt to improve the U.S. accounting standard for goodwill. FASB, however, seems intent on making the journey.

Goodwill is the excess of the price paid for a company over its fair market value when acquired, and like most intangible assets is incredibly hard to value.

The U.S. accounting standards-setter is leaning toward an amortization model for goodwill with a 10-year default amortization period, a method that was ditched in 2001. The International Accounting Standards Board, on the other hand, favors retaining the existing impairment model but adding additional disclosures. According to the CFA Institute survey, 94% of investors believe goodwill accounting standards should be internationally consistent.

People’s views on goodwill accounting tend to be shaped based on what they think goodwill is, FASB Chair Richard Jones told CFO in March.

The current impairment testing model enacted in 2001 assumes the potential synergies from a deal should be kept on the acquirers’ books forever, similar to other indefinite-life intangible assets. If necessary, finance teams write down the intangible asset’s book value, usually based on a triggering event. The largest impairment in 2020 was Baker Hughes’ $14.8 billion write-down from the takeover of General Electric’s oil and gas division in 2017.

The former amortization model assumes the goodwill acquired in takeovers is a wasting asset, like a piece of equipment, and its value can be written off according to a set schedule.

Many issues used to complain that impairment testing was a burden. But after two decades of testing, they aren’t uniformly in favor of ditching it. Indeed, private companies and nonprofits got a break on compliance this year when FASB ruled they had to test for goodwill impairments only at the time they were closing their books, instead of immediately upon learnings of a triggering event.

The U.S. debate over goodwill accounting may intensify in 2022 as FASB considers issuing an exposure draft. Goodwill accounting is on the agenda of a meeting between FASB’s private company council and its small business advisory committee. And at the FASB board meeting in November, members discussed several issues related to the amortization model.

Jones told CFO that most of the board is interested in pursuing an amortization model, albeit with some impairment testing. That proposed approach doesn’t appear to have changed.

The old amortization method has a couple of things going for it. As three professors from Suffolk University in Boston pointed out in a recent paper, “Did the Accounting for Goodwill Create a Bubble?” the logic behind it is sound: “As merger synergies materialize, they are captured in other financial statement accounts, and the value of goodwill on the books should decrease as this occurs,” according to the professors.“ Thus, as the economic benefits from goodwill are earned, the corresponding amortization expense is recorded in the income statement.”

“As merger synergies materialize, they are captured in other financial statement accounts, and the value of goodwill on the books should decrease as this occurs.”

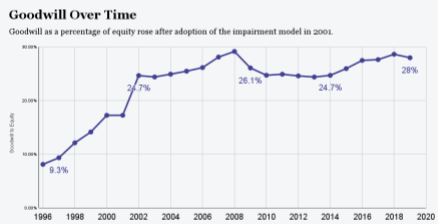

The second benefit to amortization, according to the paper, is related to the existing heaps of goodwill on U.S. companies’ balance sheets. Goodwill has ballooned to nearly 30% of the net assets of U.S. public companies from about 7% in the 1980s. In particular, it rose steadily higher with the adoption of SFAS 141, which introduced the impairment model, in 2001. That aggregate increase in goodwill occurred despite public companies completing fewer acquisitions in the past 20 years.

Sources: Compustat and Refinitiv’s SDC database; 8,800 public companies; chart from “Did the Accounting for Goodwill Create a Bubble?” by Bingyi Chen, Ariel Markelevich, and Irene Guannan Wang of Suffolk University, Boston.

Whether the paper demonstrates a correlation, it’s easy to see that a high level of goodwill is a vulnerability. Having almost one-third of a company’s balance sheet consisting of hard-to-value intangible assets is dangerous. Large and surprising goodwill write-downs blow holes in acquirers’ balance sheets. Not to mention their stock prices. For example, GE shares lost more than 35% of their value in a month in 2018 when the company posted a $22 billion write-down.

Generally, this happens during times of economic distress, which are often unpredictable. In March, Duff & Phelps estimated that the goodwill impairments for 8,800 public companies would reach $120 billion when the numbers from 2020 were tallied. That would make the pandemic year second only to 2008’s $188 billion in write-downs.

Moving to an amortization model, in contrast, could slowly reduce the portion of corporate assets accounted for as goodwill. Companies would be forced to reduce it in small bites, lowering the risk of a headline event.

But phooey to amortization, say many investors and analysts. Sandy Peters, head of the financial reporting policy group at CFA Institute, calls it the “zero information approach.” With amortization, investors couldn’t distinguish between management teams that are good at acquisitions — and those that are subpar. From the investor’s viewpoint, a material goodwill write-down is a reliable signal that management overpaid or failed to realize predicted synergies from a transaction — information highly relevant to potential suitors.

In the CFA institute survey of about 1,600 investors, more than half (58%) indicated impairment testing should be retained. However, they also want “better disclosures that facilitate the assessment of post-acquisition deal performance.” The proposed disclosures include quantitative information on how an acquisition performs over time relative to the business objective and the key performance metrics that management uses to monitor the acquisition.

The demand for more disclosures isn’t surprising. Investors always want more information, and issuers oppose revealing too much. So, it’s hard to say whether any additional disclosure rules have a chance of making the exposure draft. FASB Chair Richard Jones wants to strike a balance between investor calls for more financial information and the desire of preparers and issuers to avoid additional costly reporting burdens.

In discussing calls for disaggregated financial information at an AICPA & CIMA conference on December 7, Jones said, “If the holy grail for an investor is a thousand items in the income statement, we’re not going to achieve that.”

(Source: AICPA & CIMA – CPA Letter Daily – CFO – December 17, 2021)