The Eternal Question: What Are a Taxpayer's Chances of an IRS Audit?

As IRS budgets and audit staff continue to diminish, audit numbers are at an all-time low. But when you file your clients' returns, the most common question persists: "How likely am I to be audited?"

Taxpayers whose returns stray far away from the norm or have “large, unusual or questionable items” can always be singled out for audit. But overall, as the statistics bear out, the IRS likes to audit taxpayers with certain characteristics.

To start, individuals get more audits than business and specialty taxpayers. In 2017, the IRS reported a 1 in 184 (0.542 percent) chance of being audited for all taxpayers. For taxpayers filing individual returns, the likelihood of audit is 1 in 161 (0.623 percent). Corporations (1120, 1120-S) and partnerships are audited less than individuals – with an audit rate of 1 in 224 (0.445 percent). In 2017, the IRS audited only 1 in every 568 (0.176 percent) employment tax returns (Forms 940/941).

Individual return audit rates

Out of the 150 million taxpayers who filed in 2017, here are the IRS statistics on who experienced an audit:

|

Form 1040 taxpayer types, in descending likelihood of audit |

Returns audited |

|

International taxpayers |

1 in 19 |

|

Taxpayers with gross income before deductions of over $1 million |

1 in 23 |

|

Sole proprietors with gross income before deductions between $100,000 and $200,000 |

1 in 48 |

|

Sole proprietors with gross income before deductions between $200,000 and $1 million |

1 in 64 |

|

Taxpayers with self-employment income under $25,000 who claim the EITC |

1 in 72 |

|

OVERALL INDIVIDUAL AUDIT RATE |

1 in 161 |

|

Farmers |

1 in 228 |

|

Wage earners who make under $200,000 and don’t claim the EITC (65% of taxpayers fit this category) |

1 in 364 |

Business and specialty tax return audit rates

Out of the millions of returns filed by businesses, employers, and specialty taxpayers (estate, gift, trust returns), here are the IRS statistics on who experienced an IRS audit:

|

Business/specialty taxpayer types, in descending likelihood of audit |

Returns audited |

|

Large corporations (Form 1120, assets greater than $5 billion) |

1 in 3 |

|

Estate tax returns |

1 in 12 |

|

Large corporations (Form 1120, assets between $10 million and $5 billion) |

1 in 23 |

|

Excise tax returns |

1 in 72 |

|

Gift tax returns |

1 in 130 |

|

Small corporations (Forms 1120, not 1120-S) |

1 in 146 |

|

OVERALL CORP/PARTNERSHIP AUDIT RATE |

1 in 224 |

|

Partnership returns (Form 1065) |

1 in 260 |

|

Estate and trust income tax returns (Forms 1041) |

1 in 971 |

|

Employment tax returns (Forms 940 and 941) |

1 in 568 |

|

S corporation returns (Forms 1120-S) |

1 in 358 |

The IRS questions more returns through automated matching notices

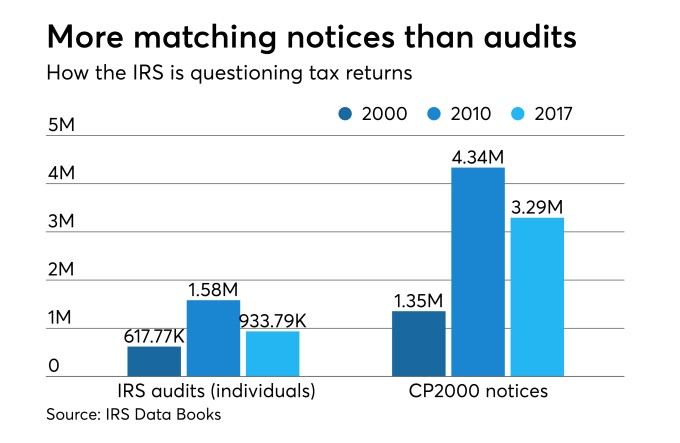

Audits are not the only way the IRS can question the accuracy of a tax return. Over the past 20 years, the IRS has ramped up more automated return checks in the form of matching programs.

For example, in the IRS CP2000 program – the automated under-reporter program – the IRS matches income between tax returns and IRS information to look for discrepancies. If there’s a mismatch, the IRS automatically sends out a notice asking for explanation. This program has increased 143 percent since 2000 – and it outnumbered audits 3.1 to 1 in 2017.

Clearly, smaller IRS budgets and personnel over the past seven years have even lowered the number of CP2000 matching notices. But automated notices have become the norm. And although CP2000 notices are not technically IRS audits, they allow the IRS to increase its ability to challenge returns far beyond what it can do through people-intensive audits. Matching notices also feel a lot like an audit for taxpayers. If you add the CP2000 matching program to the IRS “return challenge” rate for individuals, the chances of the IRS challenging an individual taxpayer’s return come out to 1 in 35 instead of 1 in 161.

The cost of an audit can be high

Audits are likely to be costly. IRS data shows that over 90 percent of individual audits result in a tax change. The average additional tax owed is $6,014 for a mail audit and $21,918 for a more intrusive IRS field audit.

CP2000s can also be costly. The IRS collected $6.7 billion in additional tax on the 3,295,000 matching notices it sent in 2017 – an average of $2,033 per notice issued.

On top of the additional tax for audits and underreporter notices, there are accuracy penalties, which can add 20 percent to the tax bill. Since 2005, the IRS has increased accuracy penalty assessments by 854 percent -- with more than 557,000 taxpayers getting an additional 20 percent penalty on their audit or CP2000 notice.

Do a proactive income review

For some taxpayers, like international taxpayers and higher-wealth taxpayers, avoiding an IRS audit can be more difficult because the IRS believes that their returns are more likely to have errors and omissions.

For most taxpayers, avoiding IRS scrutiny means reporting all wage and income documents (Forms W-2, 1099, etc.) to the IRS. Tax pros can’t get IRS information statements from the IRS before the end of filing season, so they need to rely on their client’s ability to provide them all the information.

Tax pros can do their best tax season due diligence by looking at last year’s return and IRS wage and income transcripts for sources of income. They can also do a post-filing review by obtaining their client’s current-year wage and income transcripts that are available during the summer, before the IRS issues the first CP2000 notices later in November. This post-filing review is still proactive before the IRS issues any notices. If tax pros find unreported income, they can file an amended return to avoid any potential accuracy penalty that could be associated with a notice or audit.

Clients who don’t avoid an audit or CP2000 notice will look to you for help. This is when tax professionals show their ultimate value to clients – by helping clients navigate and get the best results.

(Source: AccountingToday - Best of the Week - February 2, 2019)