General Article Archives - Page 3

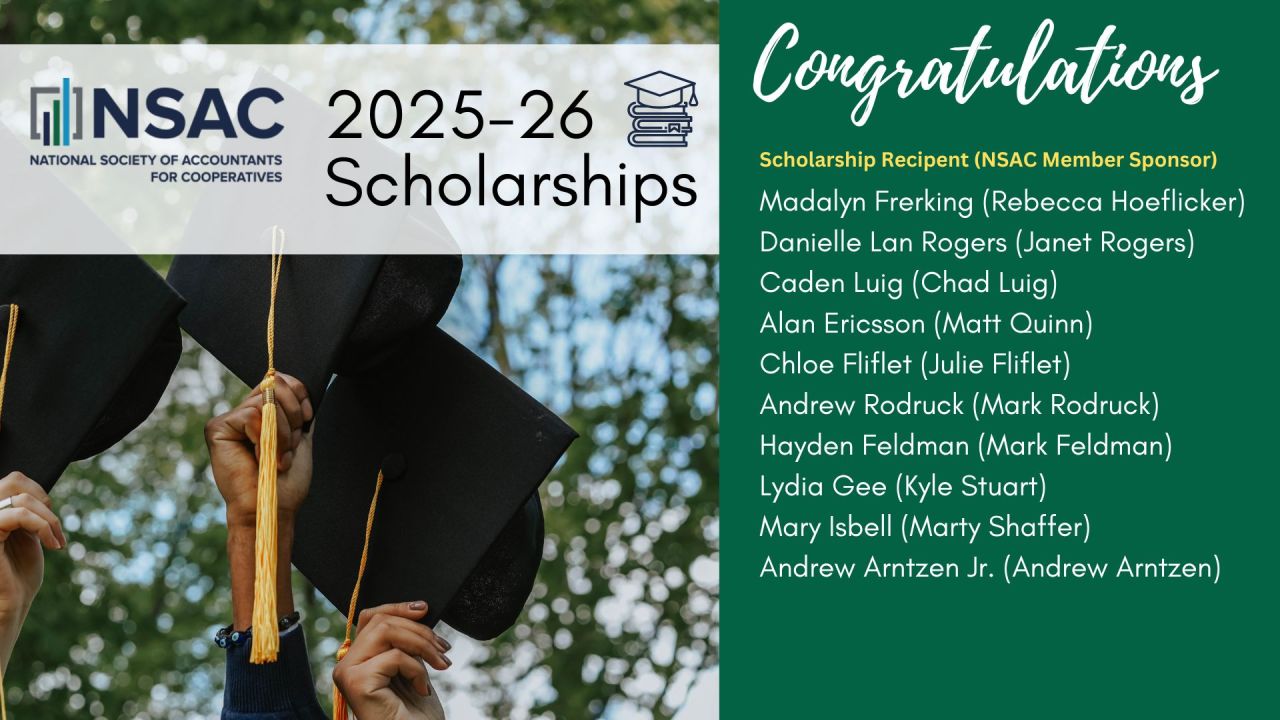

NSAC Congratulates 2025-2026 SCHOLARSHIP RECIPIENTS!

The NSAC would like to congratulate the scholarship recipients for the 2025-2026 academic school year! We're thrilled to announce that this year saw record number of entries from many talented individuals, making it an exceptionally competitive selection process. The Society is proud to commend these outstanding students for their remarkable academic achievements, and we're confident they'll reach new heights in their pursuit of ...

Read MoreTime Passes and Administrations Change, but USDA Statistics Still Measure Co-ops' Importance to Rural America

Almost 100 years ago, Congress entrusted the U.S. Department of Agriculture (USDA) with keeping statistics on agricultural cooperatives. The Cooperative Marketing Act of 1926 (CMA) created a division to provide statistical, economic, financial, and other information. In fact, the Department started collecting United States farmer cooperative statistics at least as early as 1913; since the Department was established in 1862, diligent agriculture ...

Read MoreWashington Update

Tax Extenders. At the time of this writing (April 2025), there is a long path ahead for President Trump’s “big, beautiful” tax bill. The bill would extend tax cuts and make changes to provisions enacted in the 2017 Tax Cuts and Jobs Act. Many provisions in the bill, including Section 199A(g), the deduction for farmer cooperatives, will expire at the end of 2025 without action by Congress. The bill will also include Republican ...

Read MoreNSAC Great Lakes Chapter Inducts Two Distinguished Leaders into Hall of Fame

Bloomington, IL — June 13, 2025 The National Society of Accountants for Cooperatives (NSAC) Great Lakes Chapter proudly recognized two of its most dedicated members—Rebecca Thoune, Signing Director at CLA (CliftonLarsonAllen LLP), and David Loyd, Chief Financial Officer at Three Rivers FS—by inducting them into the Chapter’s esteemed Hall of Fame during the 2025 Annual Meeting held June 12–13 in Bloomington, ...

Read MorePractical Uses of AI in Your Audit Practice

This article explores the evolving role of Artificial Intelligence (AI), particularly Generative AI (GenAI), in financial statement audits, highlighting its practical applications, adoption trends, and oversight considerations. It examines insights from the Public Company Accounting Oversight Board (PCAOB) regarding GenAI’s current uses in administrative audit functions and the associated governance challenges. The article details how ...

Read More