May 2016 Article Archives - Page 3

Countdown: 2025 Tax Provisions Set to Expire

As 2025 comes to a close, several important federal tax provisions are scheduled to expire, creating so-called “tax cliffs” that could impact households, businesses, and the broader economy. Lawmakers face critical decisions about which policies to extend, modify, or allow to lapse. Key areas affected include healthcare subsidies, clean-energy incentives, business hiring credits, and more. Understanding these expirations is ...

Read MoreNSAC Announces Board of Directors for 2025-2026 Term

The National Society of Accountants for Cooperatives (NSAC) is pleased to announce the new Board of Directors for the 2025-2026 term. The Board of Directors aids in determining the culture, strategic focus, and overall direction of the NSAC. The Board supports NSAC’s mission of serving cooperatives by providing accounting, tax and business education uniquely tailored to professionals working for and with cooperatives; providing networking ...

Read MoreCAMT Developments

As part of the Inflation Reduction Act of 2022, Congress amended Section 55 to impose a new corporate alternative minimum tax (“CAMT”) based on the “adjusted financial statement income” (“AFSI”) of an “applicable corporation” for taxable years beginning after December 31, 2022. Cooperatives generally will not be subject to the CAMT for two reasons. First, the CAMT applies only to ...

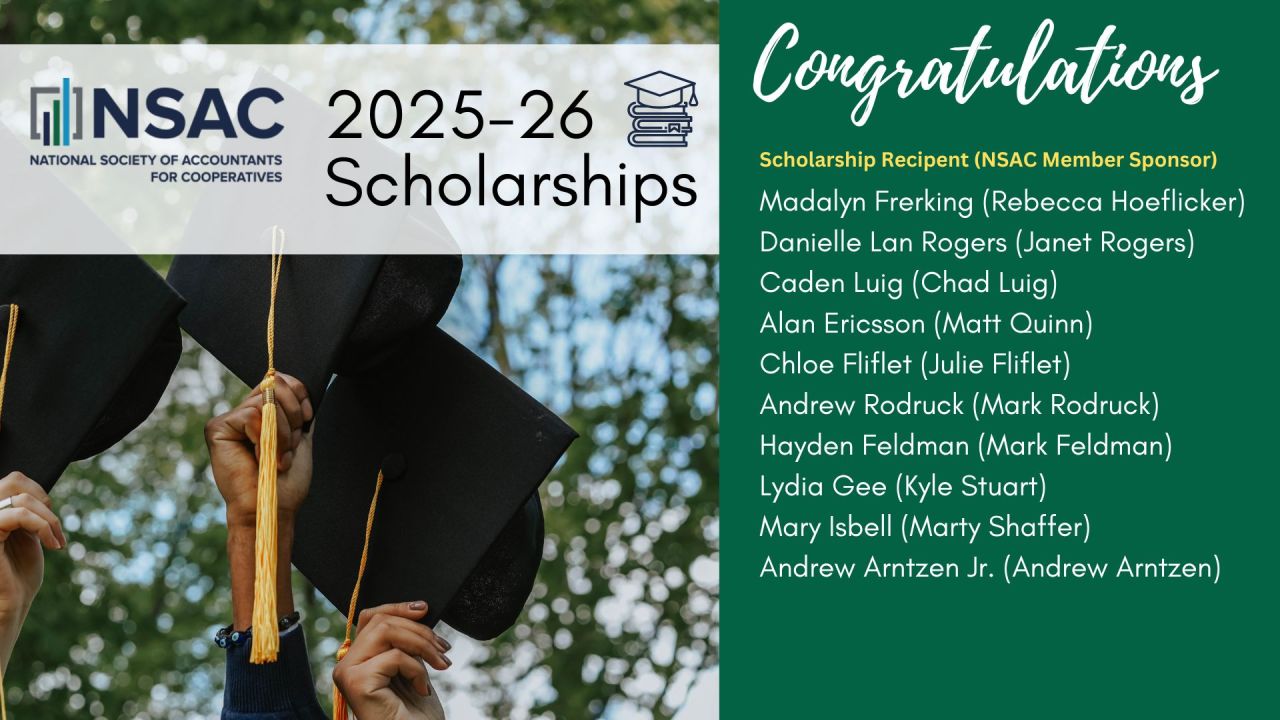

Read MoreNSAC Congratulates 2025-2026 SCHOLARSHIP RECIPIENTS!

The NSAC would like to congratulate the scholarship recipients for the 2025-2026 academic school year! We're thrilled to announce that this year saw record number of entries from many talented individuals, making it an exceptionally competitive selection process. The Society is proud to commend these outstanding students for their remarkable academic achievements, and we're confident they'll reach new heights in their pursuit of ...

Read MoreTime Passes and Administrations Change, but USDA Statistics Still Measure Co-ops' Importance to Rural America

Almost 100 years ago, Congress entrusted the U.S. Department of Agriculture (USDA) with keeping statistics on agricultural cooperatives. The Cooperative Marketing Act of 1926 (CMA) created a division to provide statistical, economic, financial, and other information. In fact, the Department started collecting United States farmer cooperative statistics at least as early as 1913; since the Department was established in 1862, diligent agriculture ...

Read More

.jpg)

.jpg)