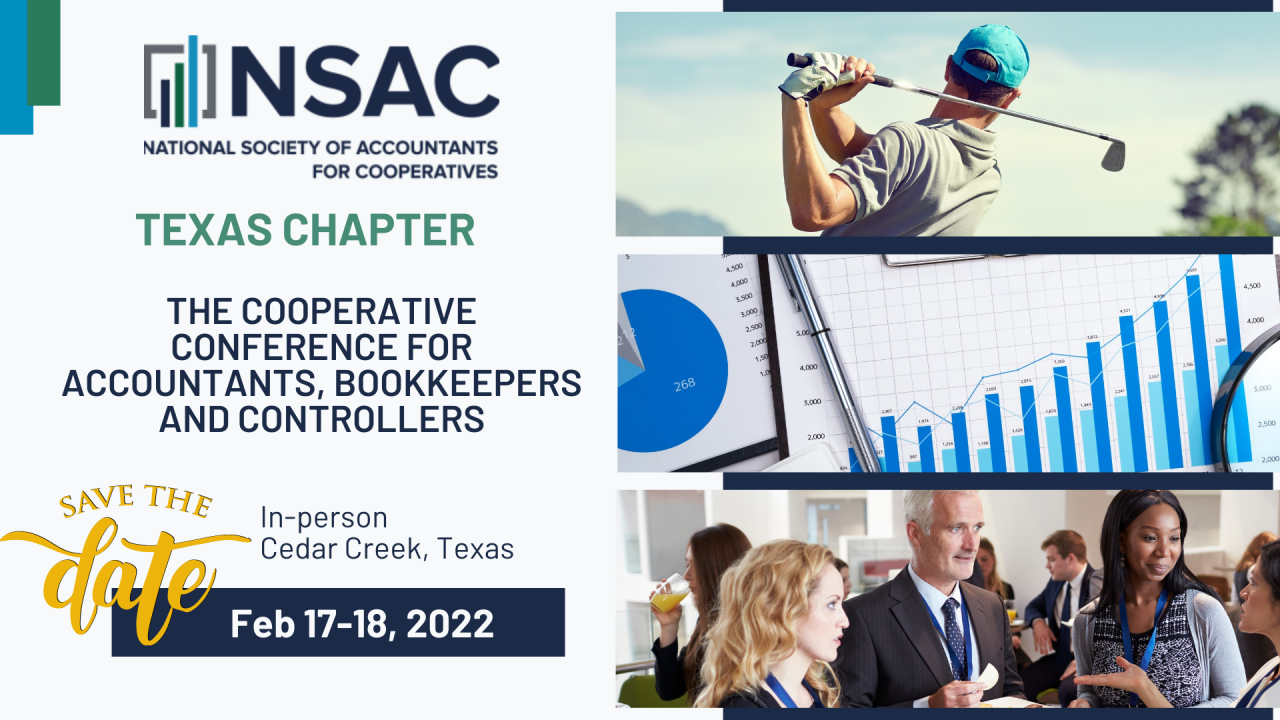

Texas Chapter Event: The Cooperative Conference for Accountants, Bookkeepers, and Controllers

Hyatt Lost Pines Resort

575 Hyatt Lost Pines Road

Cedar Creek, TX 78612

United States

Designed exclusively for cooperative accountants, bookkeepers, and controllers, this highly-anticipated meeting will include a day and a half of intermediate programming with 6.5 CPE Credits, a golf tournament, dinner and cocktails, and networking opportunities. Attendees will participate in several sessions that will enhance their understanding of current happenings within today's business environment, and hear from experts on topics relevant to the accounting world.

The meeting agenda is posted below. Please note that all times are Central Time.

Thursday, February 17th

7:00-8:00 AM: Breakfast, Welcome, Introductions, and Announcements

Russ DuBose, President, Texas Chapter - NSAC

8:00-9:15 AM: HR Compliance in 2022

Cindy Bertram, PHR, Triangle Cooperative Service Company

Cindy Bertram, PHR has 30 years of legal and human resources experience. As a West Texas State University graduate, her interest in the law and managing employees has been her passion. Her legal work includes working for the FDIC and United Healthcare. She worked for a national tradeshow company in Dallas, as an HR Director for a “renegade” trucking company in West Texas, and joined Triangle Insurance Service Corporation in 2016. Cindy manages the Human Resources Consulting for the State of Texas and the Oklahoma Panhandle for Triangle’s agricultural customers, along with other non-ag companies.

After the presentation, members of the NSAC will have a better understanding of the legal benefits of a fully compliant employee handbook, required and recommended training for employees, and navigating the employment process from recruiting, onboarding, performance management, and termination.

*Participants will earn 1.5 CPE Credits in Human Resources.

9:15-10:30 AM: Accounting and Auditing Update

Greg Taylor, CPA, D. Williams and Company

Greg grew up on a six-hundred-acre cattle and cotton farm south of Ralls, Texas. He is a shareholder with D. Williams and Company, P.C. in Lubbock, and oversees the firm’s assurance, litigation support, and valuation services. He joined D. Williams and Company, P.C. in 1989 after working with Doshier, Pickens & Francis, P.C. in Amarillo, Texas and in the Lubbock office of KPMG Peat Marwick. Greg received his B.B.A. in finance and accounting from West Texas State University (now West Texas A&M University) in 1983 and his M.B.A. from West Texas State University in 1988. Greg served as the National President of NSAC in 2008-2009.

This presentation will discuss the meaning of return on equity ownership in the cooperative ownership structure, background and examples of the employee retention credit, and observations concerning overall changes in AGI categories by income demographic.

*Participants will earn 1.5 CPE Credits in Accounting.

10:30-10:45 AM: Break

10:45-11:35 AM: Texas Sales Tax Updates and Refresher

Texas Comptroller of Public Accountants

After the presentation members of the NSAC will have a better understanding of the recent changes in Texas sales and use tax laws, how these changes affect taxpayers within the agricultural industry, as well as an overview of all the exemptions available to taxpayers in the agricultural industry.

*Participants will earn 1.0 CPE Credit in Tax.

11:35 AM: Wrap-Up and Announcements

12:30 PM: Golf Tournament (Cost is $130 per player)

6:00-7:00 PM: Cocktail Hour

7:00 PM: Dinner

Friday, February 18th

7:00-8:00 AM: Breakfast and Announcements

Russ DuBose, President, Texas Chapter - NSAC

8:00-9:15 AM: Agricultural Economic Outlook

Tommy Engelke, Executive Vice President, Texas Agricultural Cooperative Council

Tommy is starting his 25th year as CEO and 32nd year at TACC. With his 12 years at CoBank, his total years of co-op service comes to over 40 years. He is a 1971 graduate of Luling High School, a 1975 BS in Agronomy, and 1976 Masters in Agricultural Journalism graduate of Texas A&M University.

After the presentation members of the NSAC will have a better understanding of how the March Primary election impacts cooperatives, the long-term political impacts on the agricultural industry, as well as an overview of key legislators up for election and their positions on agricultural issues.

*Participants will earn 1.0 CPE Credit in Specialized Knowledge.

10:05-10:20 AM: Break

10:20-11:35 AM: Cooperative Tax Update

Josh Bakke, Senior Manager, Moss Adams

Josh has practiced public accounting since 2010, providing consulting and tax compliance services for the food and beverage and agribusiness industries. Josh’s clients include agricultural marketing and supply cooperatives, their producers, commodity brokers, food processors, private equity groups, and high-net-worth individuals. He provides consulting services related to managing cooperative patrons’ equities, the Section 199A deduction for cooperatives and their members, and taxation. Josh currently sits on the national tax committee, and Board of Directors for the Far West Chapter of the National Society of Accountants for Cooperatives.

This presentation will discuss phase-outs -- what is coming and how it will affect your coop, understanding the 199A and 263A final regulations, GAAP vs. Tax patronage, and qualified vs. non-qualified equity planning opportunities.

*Participants will earn 1.5 CPE Credit in Tax.

11:35 AM: Final Announcements and Adjourn

Hotel Reservations: The hotel block rate is $259 per night (single/double). Reservations can be made online here. The hotel cut-off date is January 26, 2022.