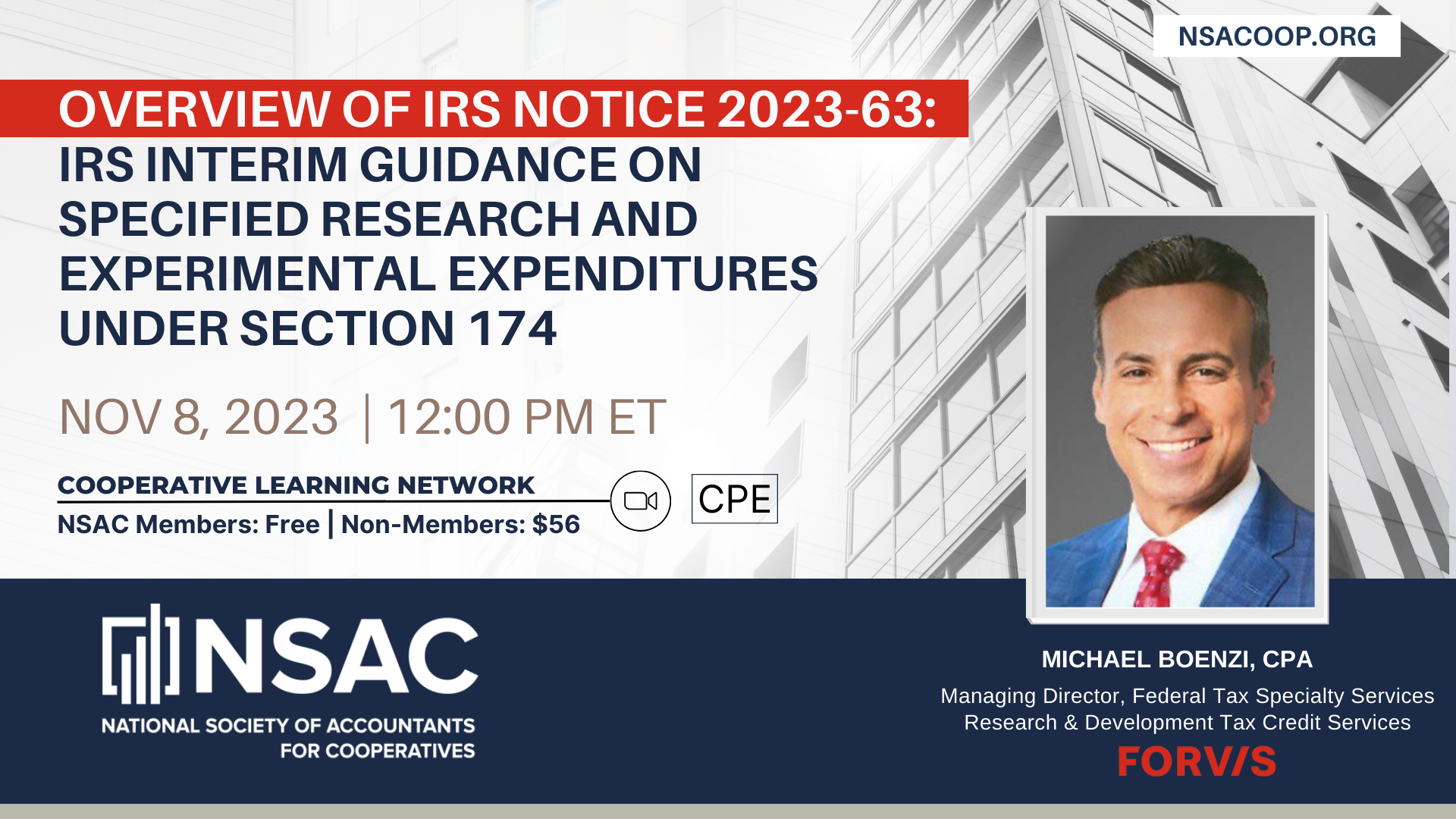

Overview of IRS Notice 2023-63: IRS Interim Guidance on Specified Research and Experimental Expenditures under Section 174

Zoom

CPE: 1.0 Credit Hours

On September 8th, the IRS issued Notice 2023-63 providing long-awaited interim guidance on the capitalization and amortization of specified research and experimental (“SRE”) expenditures under Section 174. This course will provide an overview of key areas detailed in the Notice, including:

- Capitalization and amortization of SRE Expenditures

- Scope of costs subject to capitalization

- Defining activities that constitute software development

- Determining whether costs incurred for research performed under contract are SRE expenditures

- Treatment of SRE expenditures if property is disposed of, retired or abandoned during the amortization period

Course Objectives

- Provide awareness of the specific areas of interim guidance contained in Notice 2023-63

- Understand the implications of the guidance provided on SRE expenditures subject to capitalization

- Familiarize attendees with the areas of uncertainty and related issues outside the scope of the Notice

Presenter and Moderator Bios

Presenter: Michael Boenzi, CPA, Managing Director, Federal Tax Specialty Services, Research & Development Tax Credit Services, FORVIS

As a leader in FORVIS’s R&D Tax Credit Services practice and recognized senior R&D credit expert, Mike is part of a team of industry-based, multi-disciplinary R&D credit experts that provide a wide range of services. These services include opportunity identification, initial and multiyear R&D credit analyses, annual R&D credit reviews, Section 174 studies, optimization between Section 174 and 41, orphan drug credit studies, data analysis, documentation analysis and preparation, ASC 730 and ASC 740 assessments, IRS and state examination support, and administrative appeals support.

For over 23 years, he has helped both private and public clients across a wide range of industries implement and document the credit—from start-ups and middle market firms to Russell 1000 and Fortune 500 companies. Mike has also helped clients take advantage of a suite of federal tax credits and incentives related to innovation, employment activities, real estate and capital investment, and energy efficiency and sustainability.

Mike is a recognized technical expert for R&D tax credit issues. In this role, he provides technical consultation to engagement teams and oversees the technical review of all engagements. Mike also participates in IRS national initiatives related to the credit and is involved in every examination with R&D credit issues.

Prior to joining FORVIS, Mike spent several years in a leadership role with the R&D credit and global credits and incentives practice of an international firm. A few highlights of Mike’s vast experience are listed below:

- Participated in several IRS-led working groups addressing R&D credit documentation issues, including the IRS National Taskforce and Statistical Sampling Summit

- Provided written comments to Treasury on proposed R&D credit regulations

- Published articles on R&D credit topics

- Taught R&D credit courses at the Institute for Professionals in Taxation

- Featured speaker at Tax Executives Institute and American Bar Association continuing education events addressing R&D credit issues

- Featured presenter on external webcasts regarding R&D credit issues, including the Annual Research & Development Tax Credit Symposium hosted by Morgan Lewis

Mike is a member of the American Institute of CPAs, Illinois CPA Society, National Association of Manufacturers, and Illinois Technology Association.

He is a graduate of University of Illinois, with a B.S. degree in accountancy.

Moderator: Wayne Sine, CPA, MBA, Director of Education, National Society of Accountants for Cooperatives

Wayne Sine is an experienced and highly knowledgeable professional in the field of Tax. Wayne recently retired as Tax Director from his company, Southern States Cooperative. He has extensive experience working with agricultural cooperatives and has been a long-time member of the NSAC. He is extremely active in the NSAC, serving as both past Chapter President of the Atlantic Chapter, and past Chair of the Tax Committee, and is currently serving as the NSAC Director of Education. Wayne's career is marked by several accomplishments, and he has always been involved in many organizations, spreading his knowledge. Wayne is a member of the Legal, Tax, and Accounting (LTA) Committee for the National Council of Farmer Cooperatives. He is also Past Chair of both the Tax Committee of the Virginia Chamber of Commerce and the Virginia Manufacturers Association. Wayne also served on the Tax Policy Committee at the Virginia Society of CPAs and served as past Region Vice President for the Tax Executives Institute.