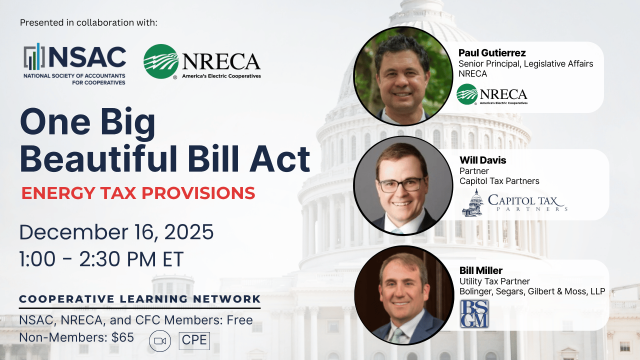

Fundamentals of Cooperative Taxation

Zoom

75-Minute Webinar

CPE: 1.5 Credit Hours

A cooperative is a special type of C-corporation that receives a deduction when it distributes patronage refunds. This webinar will provide an overview of cooperatives and cooperative regulation focusing on how the operation of a cooperative determines how it is taxed. Patronage refunds occur when earnings on business done with or for patrons of the cooperative are distributed to the patrons. The webinar will describe the rules governing these distributions including the distinction between patronage and non-patronage business. Additionally, the webinar will address the treatment of losses, the taxation of patrons, and the special domestic production activities deduction available to farmer cooperatives.

Presenter and Moderator Bios

Presenter: Meegan Moriarty

Meegan Moriarty provides consulting services to cooperatives and small businesses and advocates for cooperative development through webinars and written publications. Until September 30, 2025, she was the senior legal policy analyst for USDA Rural Development Cooperative Programs. In that position, Meegan tracked and advised on cooperative legal policy developments in state and federal tax, antitrust, securities, and agricultural law areas. She led a congressionally mandated interagency working group on cooperative development that was created to assist with coordination among federal agencies and private sector cooperative stakeholders on cooperative policy. She also led a nationwide project researching and comparing state cooperative statutes. Additionally, she was a national point of contact for Rural Development grant, loan, and guarantee programs that apply to cooperatives. She is the editor of the Small Cooperative Forum for the National Society of Cooperative Accountants’ Cooperative Accountant Magazine. She is also active with the Cooperative Professionals Guild. Previously, she worked in the National Tax office of Ernst and Young analyzing federal tax legislation and regulations and consulting with clients on business opportunities presented by tax law changes. She has a JD from Georgetown University Law Center and a BA from the University of Notre Dame.

Moderator: Wayne Sine, CPA, MBA, Education Director, National Society of Accountant for Cooperatives

After retiring as Tax Director of a regional supply cooperative on the East Coast, Wayne Sine was asked to serve as Education Director for NSAC. As an active and long-term member of NSAC, Wayne previously served as Chair of NSAC’s Tax Committee, President of the Atlantic Chapter, and was a recipient of NSAC’s Silver Bowl Award. In addition to his work with NSAC, Wayne has also served on the Legal, Tax, and Accounting (LTA) Committee of the National Council of Farmer Cooperatives, Chaired the Tax Committees for both the Virginia Chamber of Commerce and the Virginia Manufacturers Association, served on the Tax Policy Committee of the Virginia Society of CPAs, and served as Region Vice President for Tax Executives Institute.