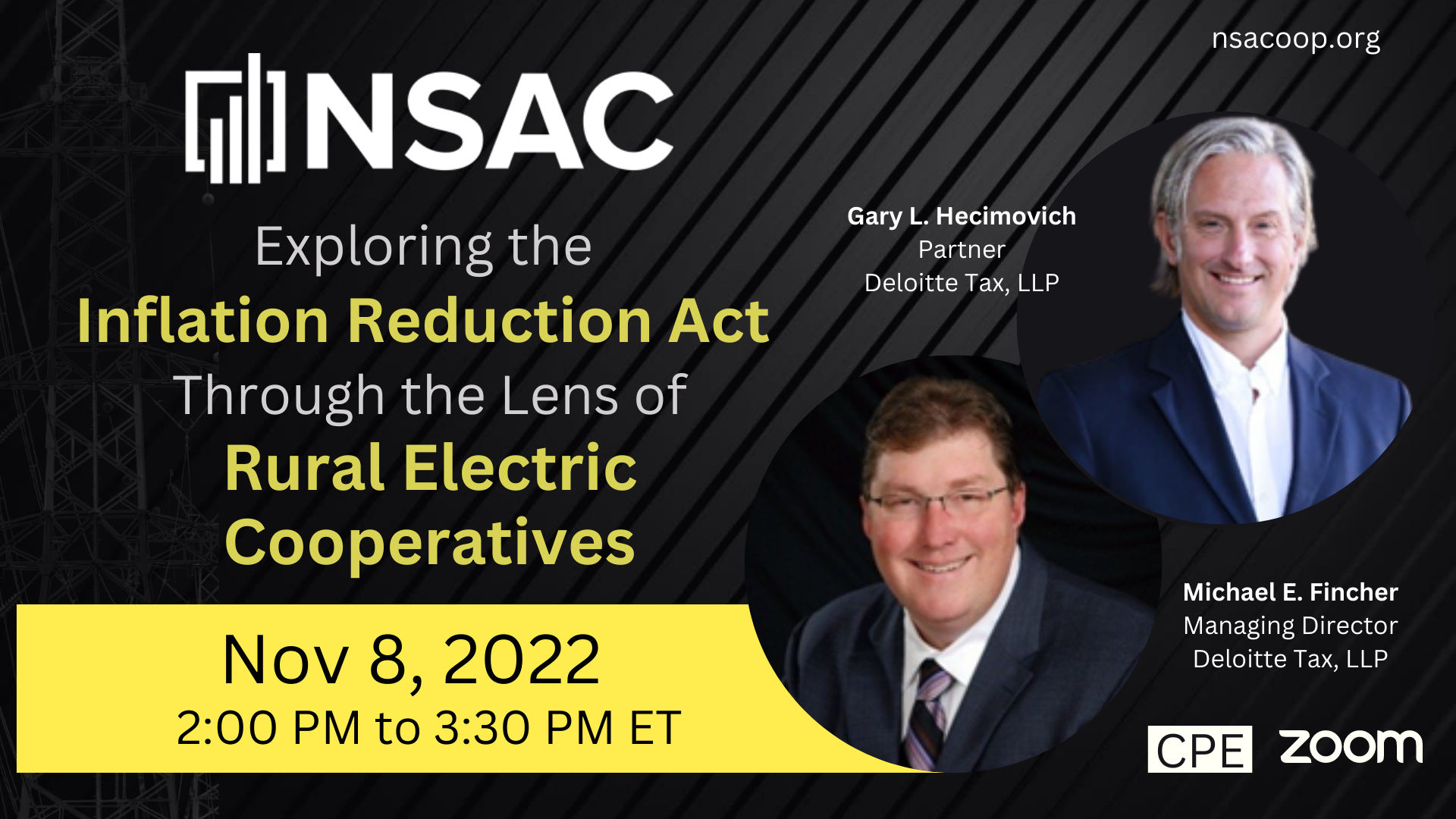

Exploring the Inflation Reduction Act through the Lens of Rural Electric Cooperatives

Zoom

CPE 1.8 credit hours

During the session of the Cooperative Learning Network (CLN), we will explore the recently enacted Inflation Reduction Act of 2022 (the “IRA”), with a focus on the sustainability credits and incentives and the related opportunities for rural electric cooperatives.

At the completion of this webinar, attendees will:

- Gain a better understanding of the various credits and incentives included in the IRA.

- Understand how the elective payment provisions of section 6417 apply to rural electric cooperatives as compared to the transferability provisions of section 6418.

- Understanding the prevailing wage and apprenticeship requirements for “bonus” credit.

Presenter and Moderator Bios

Presenter: Gary L. Hecimovich, Partner, Deloitte Tax, LLP

Gary is a partner in the Washington National Tax Office (“WNT”) of Deloitte Tax LLP. He is a member of the firm’s Federal Tax Accounting, Periods, Methods, and Credits Group and has more than 30 years of public accounting experience specializing in federal income tax credits and incentives and related accounting method issues. Gary and his team provide due diligence, structuring, tax controversy, private ruling requests, application writing and transactional consulting with respect to a wide array of federal income tax incentives including the Paycheck Protection Program, Employee Retention Credit, Qualified Opportunity Zones, Energy Tax Credits, Renewable Energy Production Tax Credits, ARRA 1603 Cash Grants, New Markets Tax Credits, Qualifying Advanced Energy Project Credits, Qualifying Therapeutic Discovery Project Credits, Historic Rehabilitation Tax Credits, Low Income Housing Tax Credits, Railroad Track Maintenance Credits, and various other incentives.

Gary is a frequent public speaker and published author on federal tax matters. His articles have appeared in Tax Notes, Journal of Accountancy, and the Tax Advisor. Gary previously served as the moderator of the firm’s Federal Tax Dbrief webcast series. He is a graduate of the University of North Carolina at Chapel Hill and is a member of the UNC Tax Center Leadership Council.

Presenter: Michael E. Fincher, Managing Director, Deloitte Tax, LLP

Michael is a Managing Director in the Minneapolis, Minnesota office of Deloitte Tax LLP with over twenty-two years of experience assisting clients in all areas of corporate and cooperative taxation. He specializes in cooperative taxation and advising on transactional planning, including the structuring of acquisitions and disposition, corporate restructurings, and consolidated return matters.

During his career with Deloitte, Michael spent two years in the National Tax office of Deloitte, located in Washington, D.C., as part of a Management Development Program assignment in the Subchapter C Group, where he was responsible for the legal research for, and the drafting of, numerous technical memorandums, opinion letters, and private letter ruling requests in the area corporate taxation. In addition to his client responsibilities, Michael leads Deloitte sponsored training seminars in the area of cooperative taxation, corporate reorganizations, mergers and acquisitions, and tax accounting periods and methods at the local, regional, and national level on a regular basis.

Michael is a member of the American Institute of Certified Public Accountants, the Vice-Chair of the Tax Committee of the National Society of Accountants for Cooperatives, an active and contributing member of the Legal, Tax and Accounting Committee of the National Council of Farmer Cooperatives, and he is a licensed certified public accountant in the states of Minnesota and South Dakota. Michael holds a Master of Science in Taxation degree from American University (Washington, D.C.), a Master of Professional Accountancy degree, and a Bachelor of Science in Business Administration degree, both from the University of South Dakota.

Moderator: Wayne Sine, CPA, Director of Education, National Society of Accountants for Cooperatives

Wayne Sine is an experienced and highly knowledgeable professional in the field of Tax. Wayne recently retired as Tax Director from his company, Southern States Cooperative. He has extensive experience working with agricultural cooperatives and has been a long-time member of the NSAC. He is extremely active in the NSAC, serving as both past Chapter President of the Atlantic Chapter, and past Chair of the Tax Committee, and is currently serving as the NSAC Director of Education.. Wayne's career is marked by several accomplishments, and he has always been involved in many organizations, spreading his knowledge. Wayne is a member of the Legal, Tax, and Accounting (LTA) Committee for the National Council of Farmer Cooperatives. He is also Past Chair of both the Tax Committee of the Virginia Chamber of Commerce and the Virginia Manufacturers Association. Wayne also served on the Tax Policy Committee at the Virginia Society of CPAs and served as past Region Vice President for the Tax Executives Institute.

.png)

.png)