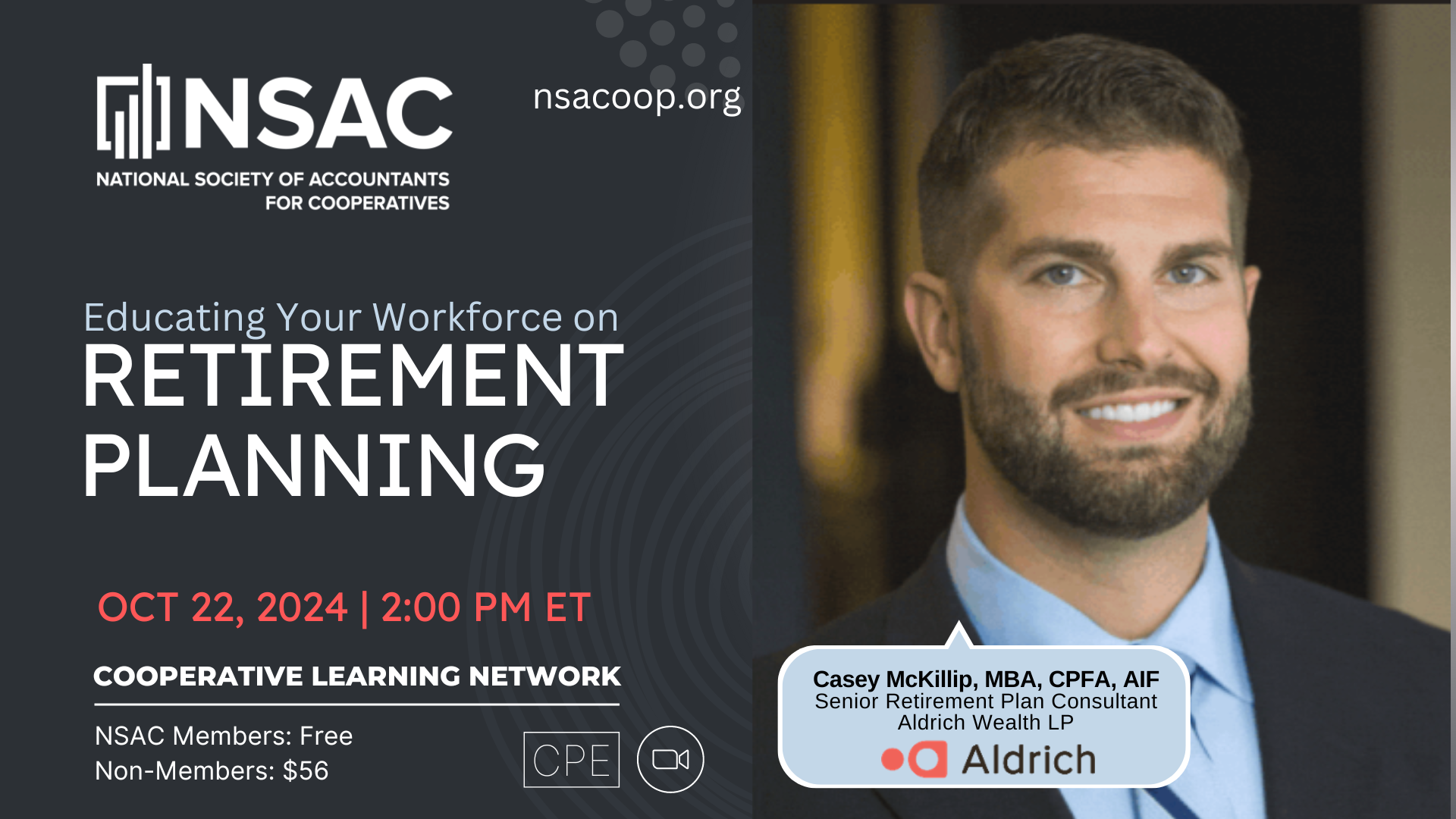

Educating Your Workforce on Retirement Planning

Zoom

CPE: 1 Credit Hour

Intended Audience: Geared for all cooperative types.

Join us as we delve into financial wellness and retirement education. Discover how to effectively empower your workforce by understanding the current landscape of retirement savings, including average 401k balances and industry trends. Learn to foster a culture that values benefits and enhances worker productivity through insightful education sessions. Gain invaluable insights into fiduciary responsibility and 404c protection, ensuring the protection of participants' interests. Explore innovative strategies for educating employees, from personalized approaches to budgeting and maximizing after-tax benefits to navigating complex decisions such as Roth vs. Traditional accounts and assessing the potential of HSAs. Leave equipped with actionable tactics to attract, retain, and elevate the financial well-being of your team, fostering a brighter future for all.

Presenter and Moderator Bios

Presenter: Casey McKillip, MBA, CPFA, AIF, Senior Retirement Plan Consultant, Aldrich Wealth LP

Casey McKillip, MBA, CPFA, AIF, is the Senior Retirement Plan Consultant at Aldrich Wealth LP. Prior to joining Aldrich, Casey was a retirement plan consultant and portfolio manager for Northwest Capital Management. His broad range of expertise included retirement plan fiduciary oversight, investment research and portfolio construction as well as providing recordkeeper platform research, fee analysis, revenue sharing and policy statement review. Prior to Northwest Capital Management, Casey worked with financial planners and advisors at Merrill Lynch, in the Portland office, providing analytical support and asset allocation recommendations. Casey earned a BS in finance and entrepreneurship from the Charles H. Lundquist College of Business at the University of Oregon and a Master of Business Administration from George Fox University. Casey has completed the Certified Health Savings Advisor course and has a Series 65 securities license, the Certified Plan Fiduciary Advisor (CPFA) designation and the Accredited Investment Fiduciary® accreditation.

Moderator: Wayne Sine, CPA, Education Director, National Society of Accountants for Cooperatives

After retiring as Tax Director for Southern States Cooperative, Wayne Sine was asked to serve as Education Director for NSAC. He has been a long-time and active member of NSAC, having served as past President of the Atlantic Chapter and past Chair of the Tax Committee. In addition to his work with NSAC, Wayne has served on the Legal, Tax, and Accounting (LTA) Committee of the National Council of Farmer Cooperatives, Chaired the Tax Committees for both the Virginia Chamber of Commerce and the Virginia Manufacturers Association, served on the Tax Policy Committee of the Virginia Society of CPAs, and served as past Region Vice President for the Tax Executives Institute.

The National Society of Accountants for Cooperatives (NSAC) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor (#103068) of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

.png)