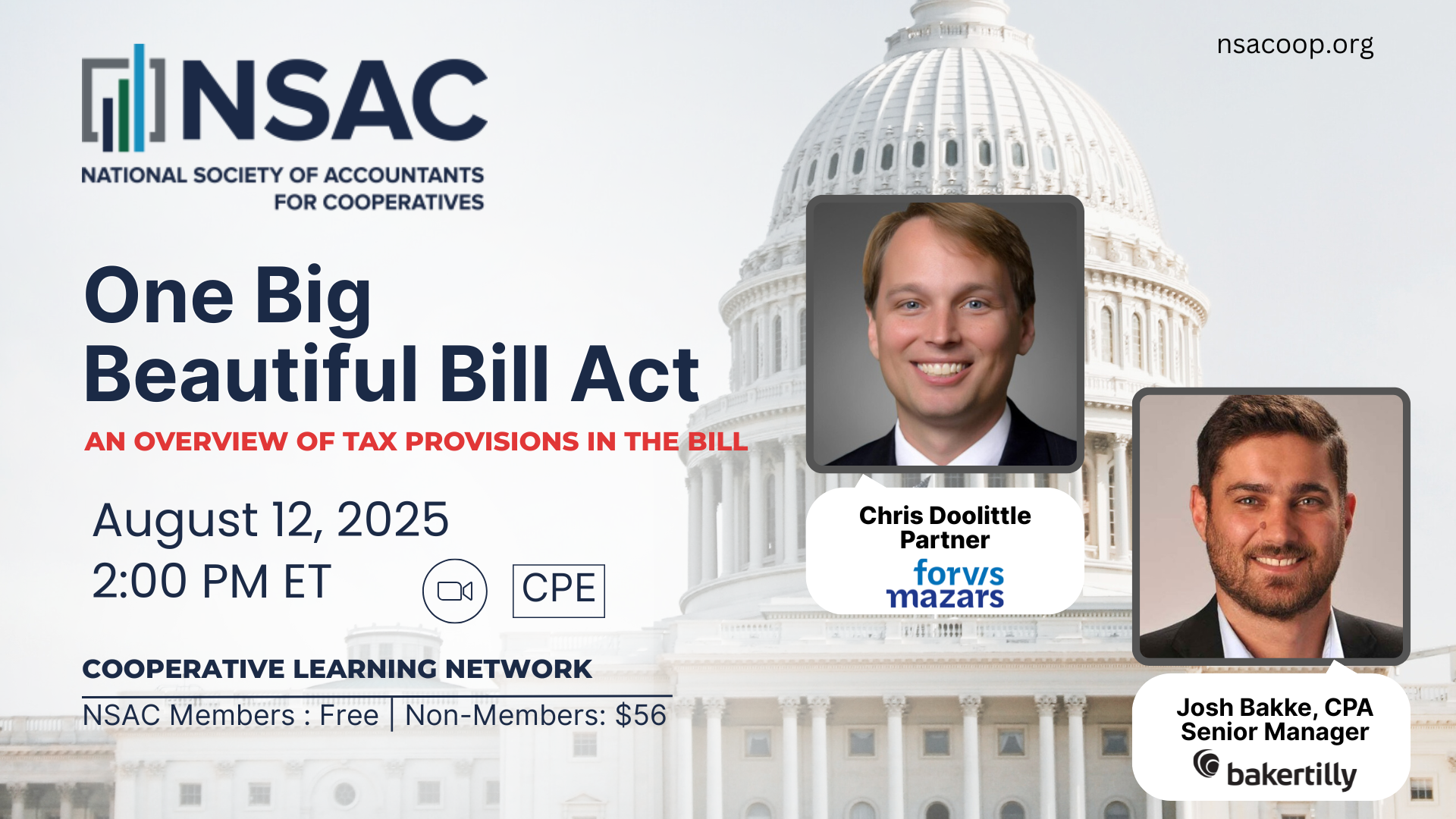

NSAC Webinar Series: Unwrap the One Big Beautiful Bill Act

With the recent passage and signing of the One Big Beautiful Bill Act, there are a lot of Individual and Business provisions to analyze. NSAC will be presenting a series of CLNs (our version of a webinar) during August to shed light on provisions that will impact NSAC's membership. The three CLNs are scheduled as follows: One Big Beautiful Bill: An Overview of Tax ProvisionsAugust 12, 2025Free for NSAC Members/ $56 ...

.png)