Companies Foresee Major Impact from Lease Accounting Standard

More than three-quarters of the top 100 U.S. companies with the biggest lease obligations expect to see a material impact on their balance sheet from the new lease accounting standard, according to a new report.

The report, from the technology company LeaseAccelerator, analyzed a recent set of Securities and Exchange Commission filings related to the adoption of the leasing standard, also known as ASC 842, which takes effect for public companies at the end of this year. The SEC Staff Accounting Bulletin 74 requires public companies to disclose the effects of accounting standards such as the leasing standard and the recent revenue recognition standard that have been announced but not yet adopted.

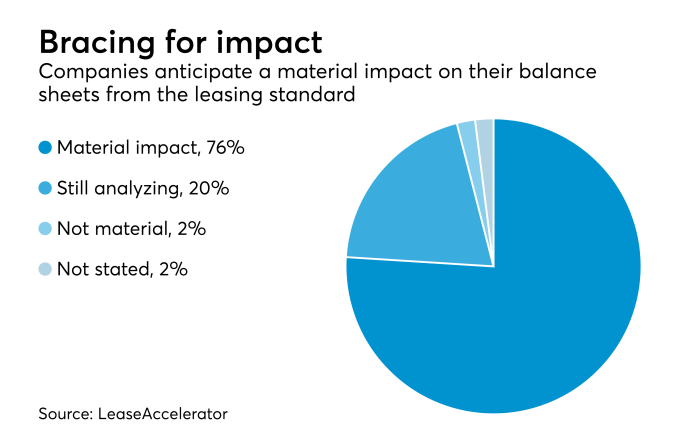

LeaseAccelerator’s report includes comments issued by the 100 U.S. companies with the highest dollar value of leasing obligations. The report found that 76 percent of the top 100 reported there will be a material impact resulting from the transfer of most right-of-use assets and liabilities on to corporate balance sheets. Another 20 percent of the companies said they’re still analyzing the potential impacts of the new standard. Only 8 percent provided quantitative estimates of the material impact to the balance sheet, which ranged from $1.2 billion to $13 billion.

On the other hand, 28 percent of the top 100 said there would not be a material impact to their income statement from ASC 842, while another 66 percent said they’re still analyzing the impacts. Nineteen percent predicted there would be no impact to their cash flow statements, while 64 percent are still analyzing the impact.

Eighteen percent of the companies examined said they’re evaluating or implementing new policies and controls to support the standard.

In terms of software, 18 percent said they’re evaluating or have selected a lease accounting software application. Only 13 percent indicated they have formed a project team to address the lease accounting standard.

“As expected, the SAB 74 disclosures confirm that most companies are expecting a material impact to their balance sheets when they adopt ASC 842 and IFRS 16,” said LeaseAccelerator CEO Michael Keeler in a statement. “However, the lack of implementation progress suggests there is still a long road to compliance for many large lessees, each of which will need to implement new enterprise lease accounting systems, policies and controls.”

One of the companies that made a disclosure was Apple, which said, “While the company is currently evaluating the timing and impact of adopting ASU 2016-02, currently the company anticipates recording lease assets and liabilities in excess of $9 .6 billion on its condensed consolidated balance sheets, with no material impact to its condensed consolidated statements of operations. However, the ultimate impact of adopting ASU 2016-02 will depend on the company’s lease portfolio as of the adoption date.”

The Walt Disney Company said, “As of September 30, 2017, the company had an estimated $3 .3 billion in undiscounted future minimum lease commitments.”

(Source: AccountingToday - Audit and Accounting - April 23, 2018)